In fact there is only one minor change which applies to the medical expenses and examination of the individual spouse or child. 20182019 Malaysian Tax Booklet Personal Income Tax.

Why It Matters In Paying Taxes Doing Business World Bank Group

Accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as individual.

. Malaysia Personal Income Tax Rate was 30 in 2022. This translates to roughly RM2833 per month after EPF deductions or about RM3000 net. Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. Nonresident individuals are taxed. To increase the disposable income of middle-income taxpayers and address the rising cost of living the 2018 budget would reduce individual income tax rates for resident individuals by 2 for three of the chargeable income bands ranging from MYR 20001 to MYR 70000 as follows.

Tax Rate Table 2018 Malaysia masuzi December 14 2018 Uncategorized Leave a comment 0 Views Income tax how to calculate bonus and personal tax archives updates malaysian tax issues for expats audit tax accountancy in johor bahru. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Introduction Individual Income Tax.

Malaysia Personal Income Tax Rate. Any individual earning a minimum of RM34000 after EPF deductions must register a tax file. Sales tax fully waived for new passenger vehicles.

Introduction Individual Income Tax. Tax relief refers to a reduction in the amount of tax an individual or company has to pay. Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the.

RM9000 for individuals. Monthly Tax Deduction 2018 for Malaysia Tax Residents optionname00. The income tax filing process in Malaysia.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. It should be noted that this takes into account all your income and not only your salary from work. Individual Life Cycle.

Now that youre up to speed on whether youre eligible for taxes and how the tax rates work lets get down to the business of actually filing your taxes. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except. If you have no clue what the answers for these questions are.

100 exemption on import and excise duties sales tax and road tax for electric vehicles. 20182019 Malaysian Tax Booklet 21 year and in any 3 of the 4 immediately preceding years he was in Malaysia for at. Nonresident individuals are taxed at a flat rate of 28.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. The Simple PCB calculator takes into account of RM2000 special tax relief limit that capped at income RM8000mth. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022.

Assessment Year 2018-2019 Chargeable Income. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so. 23 rows Tax Relief Year 2018.

The system is thus based on the taxpayers ability to pay. Income Tax Table 2018 Malaysia masuzi December 12 2018 Uncategorized Leave a comment 21 Views Individual income tax in malaysia for audit tax accountancy in johor bahru rates irs announces 2018 tax brackets. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

13 rows Personal income tax rates. 12 rows Income tax relief Malaysia 2018 vs 2017. Malaysia personal income tax guide 2019 YA 2018 242019 62800 AM KUALA LUMPUR April 2 Income tax season is here in Malaysia so lets see how ready you are to file your taxes.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. The relevant proposals from an individual income tax Malaysia 2018 perspective are summarized below. Offences Penalties Failure to furnish Income Tax Return RM200 to RM20000 or imprisonment or both on conviction or 300 of tax payable in lieu of prosecution Failure to furnish Income Tax Return for 2 YAs or more RM1000 to RM20000 or imprisonment or.

The amount of tax relief 2018 is determined according to governments graduated scale. Under the current legislation the income tax structure for resident individuals is based on progressive tax rates ranging from 0 to 28 on chargeable income. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with.

Up to RM3000 for kindergarten and daycare fees. Calculations RM Rate TaxRM 0 - 5000. Reduction of certain individual income tax rates.

Offences under the Income Tax Act 1967 and the penalties thereof include the following. United Arab Emirates 1605 GDP. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income.

The deadline for filing income tax in Malaysia is April 30 2019 for manual filing and May 15 2019 via e-Filing. Headquarters of Inland Revenue Board Of Malaysia. On the First 5000.

Unlike the income tax rates for 2018 and 2017 there is virtually no change in income tax reliefs for the two assessment years.

Reliefs For Personal Income Tax 2017 Vs 2016 Teh Partners

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

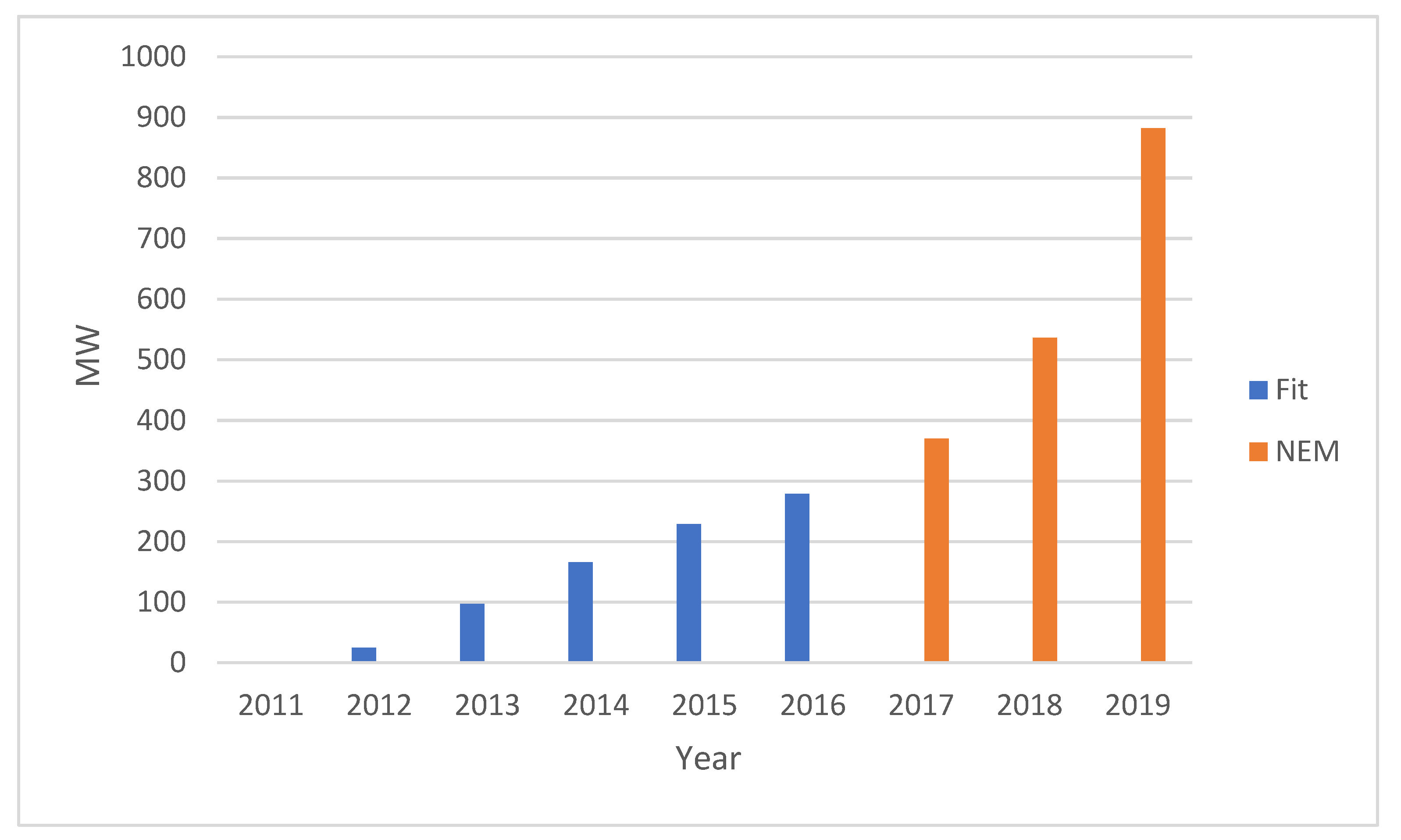

Sustainability Free Full Text A Decade Of Transitioning Malaysia Toward A High Solar Pv Energy Penetration Nation Html

Malaysia Personal Income Tax Relief 2021

New Zealand 2020 21 Income Tax Year Taxing Wages 2021 Oecd Ilibrary

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

7 Tips To File Malaysian Income Tax For Beginners

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Thailand S New Personal Income Tax Structure Comes Into Effect Asean Business News

Cukai Pendapatan How To File Income Tax In Malaysia

Income Tax Malaysia 2018 Mypf My

Gst In Malaysia Will It Return After Being Abolished In 2018

Singapore Tax Rate Personal Individual Income Tax Rates In Singapore Updated